4 April 2019: As ArcelorMittal SA inches closer to its first acquisition in India, the Luxembourg-based steel giant is readying a crack team that can take control of Essar Steel as soon as the deal is completed. Mint has learnt that the company has finalized office space in Mumbai and engaged Korn Ferry, a Los Angeles-based management consultancy, to hire senior executives for the new team.

ArcelorMittal has taken up around 300 seats at CoWrks in Mumbai, two people aware of the matter said. CoWrks is a shared office space provider promoted by Bengaluru-based realty firm RMZ Corp. In Mumbai, it runs a three-storey shared office space spread over 130,000 square feet that can seat up to 2,000 people. The current occupants include Ericsson AB, Boeing Co., ZTE and Razorpay.

It is unclear when ArcelorMittal plans to start operations from CoWrks and the term of its lease. The shared workspaces are typically leased for a few months to up to 10 years, said a CoWrks official, requesting anonymity.

“It’s common practice even for large companies to take up space at co-working offices. What it provides is flexibility as well as the speed of starting their operations. Secondly, it gives flexibility to expand or contract when required while they are testing their business model. Third is the hassle-free environment as companies do not have to manage the space,” said an executive with a shared office provider.

Essar Steel had 3,806 employees as of March 2018, as per its most recent annual report. It operates a 10 million tonne per year steel plant at Hazira, Gujarat.

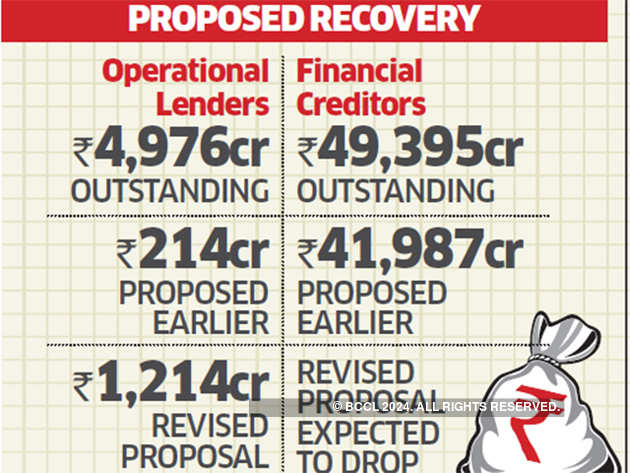

While ArcelorMittal’s takeover bid for Essar Steel has been approved by the National Company Law Appellate Tribunal (NCLAT), lenders to Essar Steel are debating how the ₹42,000 crore upfront cash payment offered by the buyer will be split among various parties.

ArcelorMittal has given Korn Ferry the mandate to review the management team at Essar Steel and hire for senior positions, said two other people aware of the matter. The steel giant may be working with more consultants, these people said.

“The entire India acquisition is being driven by Aditya Mittal who has set up a large cross-functional team out of ArcelorMittal Belgium,” the first of the two people said. “ArcelorMittal employs several Indian expats across the world; they are likely to have identified CXOs out of the ArcelorMittal Belgium team. I think when they finally come in, they want to hit the ground running and turn the company around as soon as possible.”

Aditya Mittal is the son of Lakshmi Niwas Mittal, ArcelorMittal chairman and chief executive officer. A spokesperson for ArcelorMittal did not respond to emailed queries. Senior executives at Korn Ferry India and CoWrks did not comment.

“Unlike other steel companies that were completely stripped off talent by the time they were acquired under IBC (Insolvency and Bankruptcy Code), Essar Steel has very good manufacturing and marketing talent,” the first person said.

“So, I think this cross-functional team will first come to India, and they will review the entire senior and mid-level leadership team to assess fitment and capabilities, and the Essar structure and give them feedback. After the takeover and after putting all these things in place, they will recruit to fill the gaps.”

A senior executive at a private steel producer said ArcelorMittal may also explore executives at other steel companies. “But that maybe six months from now, not right away,” the executive said.

Anticipating this move, private steel producers are already identifying and ring-fencing their key talent and conducting risk-retention analysis. “However, we’re not too sure if there will be a large exodus because Essar already has a large team in place.”

“For manufacturing companies like ArcelorMittal, they would probably cast the net wider when it comes to looking for talents. Some of the roles would also be local in nature. These days the trend is not to look only among competitors but also to hire from outside the industry,” said Ronesh Puri, managing director, Executive Excess (India) Ltd, a hiring firm.

The LiveMint reported

You must be logged in to post a comment.