2 May 2019: The Insolvency and Bankruptcy Board of India (IBBI) is seeking to penalise ‘flippant’ bidders and managers of stressed assets to help quicken the recovery of banking funds locked in bad loans and prevent fraud at companies put into administration.

After a Liberty House plan for a stressed automotive asset didn’t result in payments, IBBI has filed nearly a dozen cases in the past two months to punish fraud linked to bankruptcies, two people with direct knowledge of the matter told ET. An email sent to IBBI seeking its comments remained unanswered until the publication of this report.

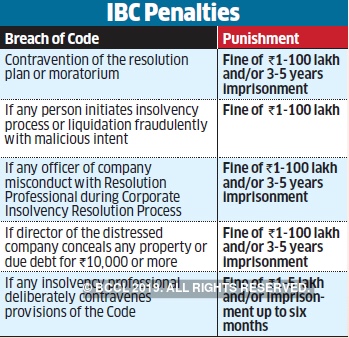

Likely offences include malicious initiation of insolvency proceedings, wilful concealment of company properties, misconduct by any officer of the borrower during the resolution, and the administration fraud.

Penalties include jail terms ranging from one to five years, and fines up to Rs 1 crore. “Speedy action by IBBI will act as a deterrent,” said Anil Goel, founder of AAA Insolvency Professionals LLP. “We have experienced various cases of planned insolvency where the property of the cor- porate debtor is concealed or removed or taken away for personal benefits before the commencement of the insolvency process.”

There are 28 special courts in India dealing with prosecutions in insolvencies. These dedicated courts established three years ago, will only hear cases against alleged offences under the Insolvency and Bankruptcy Code (IBC).

The objective behind setting up these special courts was the speedy disposal of cases. Ever since IBC was introduced in December 2016, specific provisions stipulating punishment have not been used so far. Last year, London-based Liberty House had won the race to acquire Amtek Auto for Rs 4,400 crore. But it failed to implement the resolution plan and make any payments to banks, prompting creditors of the distressed company to take legal action.