Denbury Resources Inc (DNR: NYSE) is Texas, US Based independent oil and natural gas company with 288.6 MMBOE of proved oil and natural gas reserves, with operations in the Rocky Mountain and Gulf Coast regions of North America.

Covenant Summary – On 17 February 2016, DNR entered into second amendment to its credit agreement before its annual scheduled redetermination, which was to take place on May 2016.Under the amendment, lenders agreed to increase senior secured leverage covenant to 3.0 x from 2.5x, previously and decrease minimum interest coverage to 1.25x from 2.25x, till 2017, which gives the company a bit of room to be in compliance with the covenants. On the other hand, total commitments under the revolver reduced to USD 1.5bn from USD 1.6bn. Additionally, applicable margins increased by 75bps which now ranges from 2% to 3%. As of 23 February 2016, the company had USD 3.3bn outstanding debt against USD 1.3bn total liquidity comprising USD 2.8m cash and USD 1.3bn available under its revolver. Consequently, on 3 February 2016, Moody’s Investors Service downgraded Denbury’s corporate family rating to ‘Caa2’ from ‘Ba3’ and senior subordinated notes to Caa3 from B1 with outlook negative.

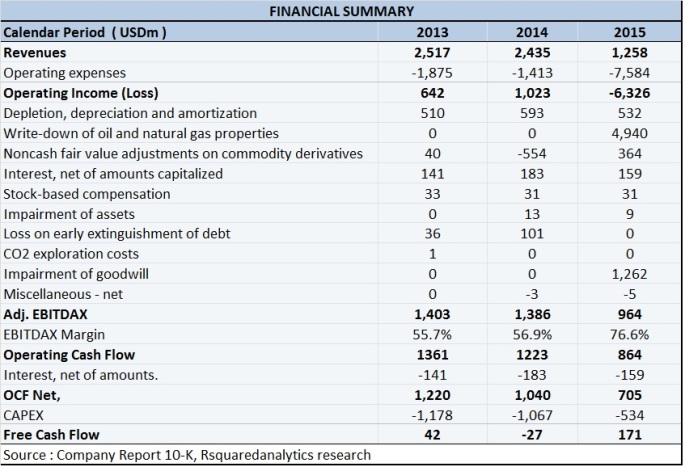

Top Line- Over the recent past oil and exploration industry has witnessed significant downturn due to declining oil prices and high inventory level. In 4Q14 oil prices further declined dramatically below USD 27 per Bbl in January 2016 from USD 94per Bbl 2014, the lowest recorded over last 10 year. As a result Denbury’s average realized oil price, excluding derivative contracts was down to USD 47.30 per Bbl in 2015 from USD 90.74 per Bbl in 2014. Following this, DNR’s total revenue plunged 48% year-over-year (YoY) to USD 1.26bn in 2015 as compared to USD 2.43bn in FY14.

Production Overview- in FY15, Denbury’s average production was down 2% YoY to 72,861 BOE/d (including tertiary production of 41,602 Bbls/d and non-tertiary production of 31,259 BOE/d), mainly due to decline in production of mature tertiary properties in the Gulf Coast region. Additionally, in late 2015, DNR decided to shut incremental production of 1000 BOE/d due to economic reasons. DNR anticipates 2016 production to be in the range of 64,000 BOE/d- 68,000 BOE/d, down 7% from 2015 levels. Further,the company entered into additional hedges to save itself from current slump in oil pricing, which covers a total of 36,000 Bbl/d for 1Q16, 34,000 Bbl/d for 2Q16, 24,000 Bbl/s for 3Q16, 30,000 Bbl/s for 4Q16 and 3,000 Bbl/s for 1Q17.

EBITDAX– DNR successfully lowered lease operating expenses and General and administrative expenses by 26% and 10% YoY, respectively, due to 11% involuntary workforce reduction initiated in 2H15. However despite this EBITDAX declined 30.5% YoY to USD 964m from USD 1.39bn on the back of aforementioned decline in revenue.

FCF- During the year, operating cash flow dipped 41% YoY to USD 864m due to abovementioned decline in EBITDAX, while free cash flow turned positive to USD 171m from negative USD 27m in 2014, owing to reduction in capex to USD 534m in 2015 from USD 1.07bn in 2014. For 2016, DNR has guided USD 200m capital expenditure.

Going forward, as per EIA’s (U.S Energy Information Agency) oil prices are likely to hover around USD 37 per barrel in 2016, as a result the earnings in the coming quarter could be negatively impacted.